aurora co sales tax calculator

This is an estimate onlyDo not write a check out for this amount. The New York sales tax rate is currently.

Colorado 2022 Sales Tax Guide And Calculator 2022 Taxjar

You can print a.

. The County sales tax rate is. Colorado has a 29 statewide sales tax rate but also has 276 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4079 on top. DR 0800 - Use the DR 0800 to look up local jurisdiction codes.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The minimum combined 2021 sales tax rate for Aurora Colorado is.

Registration Fees Fees are based on the empty weight and type of vehicle being registered CRS. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. Wayfair Inc affect Colorado.

You can find more tax rates and allowances for Aurora Cd Only and Colorado in the 2022 Colorado Tax Tables. 101 rows How 2022 Sales taxes are calculated for zip code 80014. If your business is located in a self-collected jurisdiction you must apply for a.

Sales Tax State Local Sales Tax on Food. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. The December 2020 total local sales tax rate was also 8000.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. ICalculators Australian Tax Calculator includes the following tax tables expenses and allowances you can check each year if you wish to query a specific allowance or threshold used if you would like us to add additional historical years please get in touch. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

The sales tax jurisdiction name is Aurora Arapahoe Co which may refer to a local government division. This is the total of state county and city sales tax rates. What is the sales tax rate in East Aurora New York.

Aurora Cd Only in Colorado has a tax rate of 7 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora Cd Only totaling 41. Sales Tax Calculator Sales Tax Table The state sales tax rate in Colorado is 2900. With local taxes the total sales tax rate is between 2900 and 11200.

If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. The Aurora Sales Tax is collected by the merchant on all qualifying sales. 101 rows How 2022 Sales taxes are calculated for zip code 80018.

Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. This estimate will include license fees and ownership tax only based on the weight age and taxable value of the vehicleIt will not include sales tax. The County sales tax rate is.

The Aurora sales tax rate is. This document lists the sales and use tax rates for all Colorado cities counties and special districts. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Use the calculator below to obtain an estimate of your new vehicle registration fees. It also contains contact information for all self-collected jurisdictions. Real property tax on median home.

The 80014 Aurora Colorado general sales tax rate is 8. This is the total of state county and city sales tax rates. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

The combined rate used in this calculator 8 is the result of the Colorado state rate 29 the 80014s county rate 025 the Aurora tax rate 375 and in some case special rate 11. Australia Tax Tables available in this calculator. Did South Dakota v.

The Colorado sales tax rate is currently. The 8 sales tax rate in Aurora consists of 29 Colorado state sales tax 025 Adams County sales tax 375 Aurora tax and 11 Special tax. Did South Dakota v.

Background - Understand the importance of properly completing the DR 0024 form. 2024 Tax Tables 2023 Tax Tables 2022 Tax Tables 2021 Tax Tables 2020. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month.

The East Aurora sales tax rate is. The current total local sales tax rate in Aurora CO is 8000. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. See tax rates and fees in Arapahoe County. The minimum combined 2022 sales tax rate for East Aurora New York is.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following. File Aurora Taxes Online. Effective July 1 2006 the Scientific and Cultural facilities District CD of 010 consists of all areas within Arapahoe County Effective December 31 2011 the Football District salesuse tax of 010 expired within Arapahoe County.

All fields are required.

Missouri Car Sales Tax Calculator

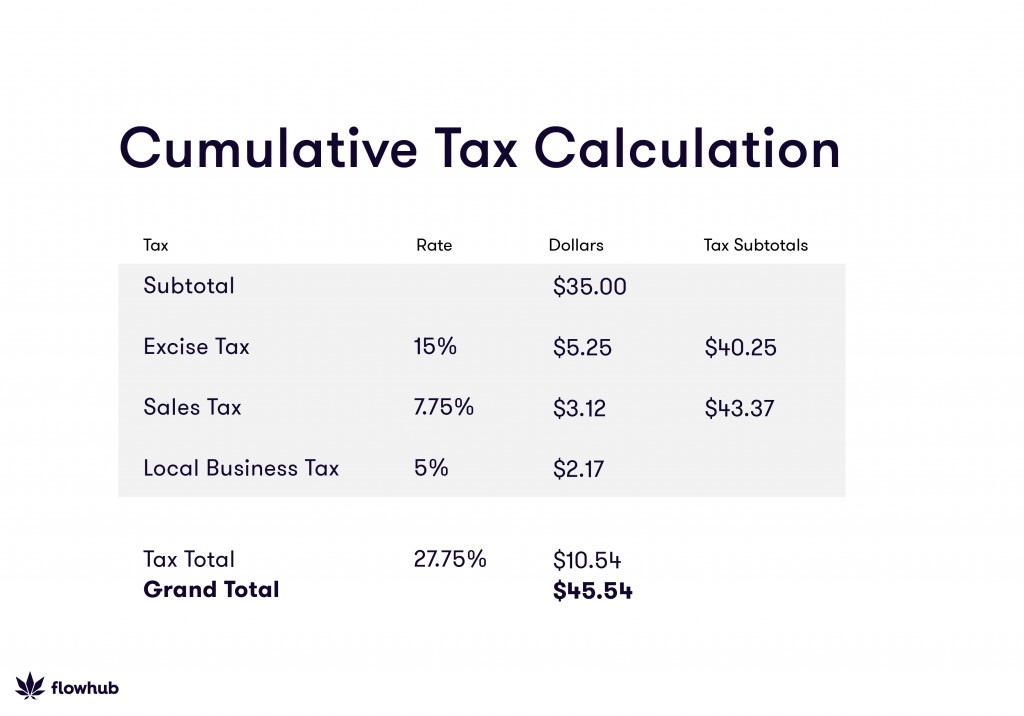

How To Calculate Cannabis Taxes At Your Dispensary

Illinois Car Sales Tax Countryside Autobarn Volkswagen

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Aurora Colorado Sales Tax Rate Sales Taxes By City

How To Use Tax Function On Calculator Youtube